According to a notice issued by the Ministry of Commerce on February 25th 2011, foreign investors can invest with Renminbi in China to establish new enterprise, increase registered capital of the existing enterprise, purchase domestic enterprises, provide loans, etc . Lee & Lee Associates Comments: To foreign investor, this rule increase ways of RMB utilization and […]

SAFE recently opened the options trading market for RMB against foreign currency. Lee & Lee Associates Comments: Domestic enterprises which shall conduct foreign currency transactions frequently or have material foreign currency assets or liabilities may be exposed to high foreign exchange risk and can consider reduce risk through tools such as that developed by SAFE above. […]

According to a supplementary provision issued by SAT on Jan. 30th 2011, method to calculate unpaid tax for employer’s contribution to the employer’s annuity in previous years is clarified. Lee & Lee Associates Comments: The administration on taxation of employers’ Annuity is strengthened. Even the relevant tax is individual income tax, since the employer shall fulfill […]

As an independent member firm of global alliance Alliott Group, we are in an optimal position during and beyond the COVID-19 crisis to connect clients with branches or subsidiaries in other countries to trusted accounting and legal professionals in 70 countries. Our colleagues around the world will be able to provide free information to you […]

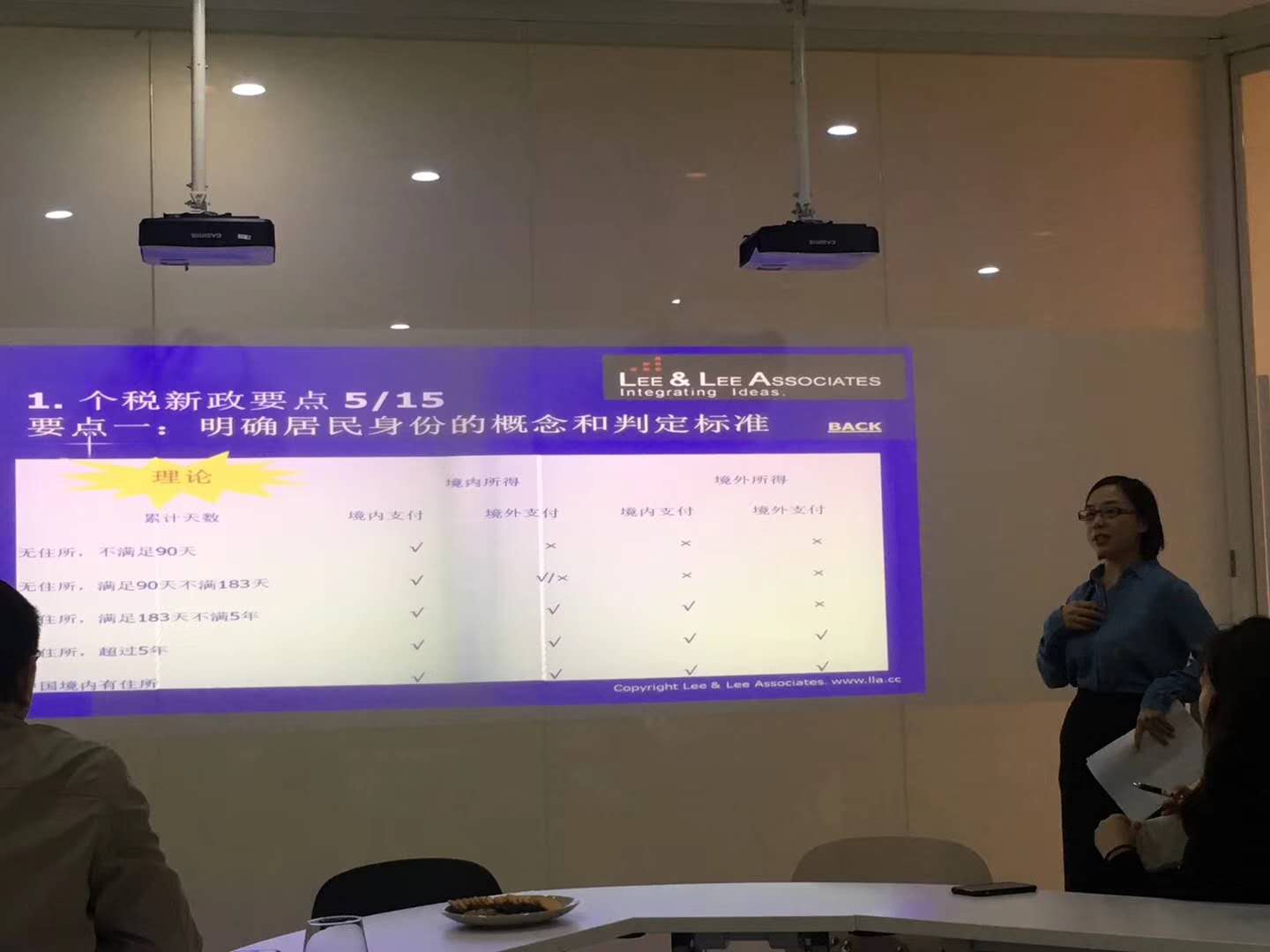

Invited by BenCham, Ms. Sophie Tian, Accounting and Tax Manager of Lee & Lee Associates, delivered a tax seminar for the Chamber’s members in Shanghai on Nov 5th, 2019. The seminar talked about how new IIT Law which was published and took into effect from Jan 1st, 2019 has influenced foreign companies and foreign individuals […]

Under kind invitation of CBBC, business consulting expert Ms. Marcia Lin from Lee & Lee Associates held a professional seminar for Launchpad of CBBC with topic “Top 10 Frequently Asked Questions When Establish A Business in China”. The ten questions were concluded from the rich client service experience of Lee & Lee Associates, including: Total […]

Thanks to the good feedback of the tax seminar for CCBC Beijing office, the Canada China Business Council (CCBC) Shanghai office then invited tax expert Ms. Sophie Tian of Lee & Lee Associates to hold another seminar for members in Shanghai on 17 January 2019. This time, the seminar focused on IIT law and the […]

On August 31st, the new IIT law was finalized and will officially be in place from January 1st, 2019. Furthermore, the tax authorities will take over the responsibility for collecting social insurances starting from the same date. These two new policies have triggered heated public discussion, and it will also bring new challenges to enterprises. […]

In 2018, China government issues many new tax regulations, the content covers many tax items, for example, VAT, CIT, stamp duty and IIT. How do these new tax regulations influence foreign companies and foreign individuals in China? Especially the new IIT law which will be taken into effect from Jan 1st, 2019, it will be […]

New Individual Income Tax (IIT) Law is in effective, but the implementation regulation is still exposure draft. On invitation of Danish CEO Club, regular tax speaker Ms. Sophie Tian of Lee & Lee Associates held one tax seminar on IIT for their members on 6 November 2018. Ms. Sophie Tian talked about the changes of […]